Homeowners Insurance in and around Sedalia

Protect what's important from the unexpected.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

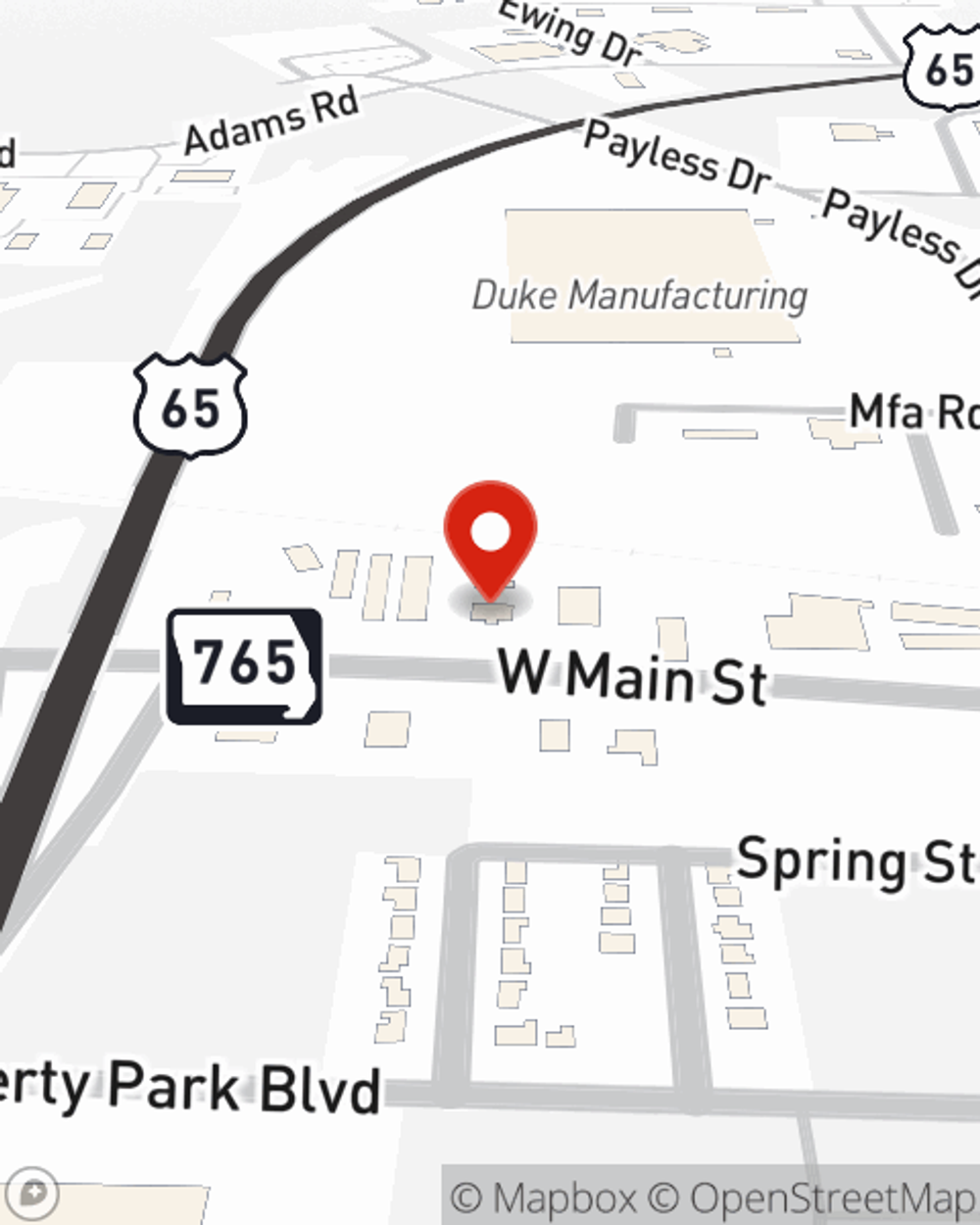

There are plenty of choices for home insurance in Sedalia. Sorting through savings options and deductibles is a lot to deal with. But if you want surprisingly great priced homeowners insurance, choose State Farm. Your friends and neighbors in Sedalia enjoy remarkable value and hassle-free service by working with State Farm Agent Margaret Ward. That’s because Margaret Ward can walk you through the whole insurance process, step by step, to help ensure you have coverage for your home as well as furniture, souvenirs, mementos, jewelry, and more!

Protect what's important from the unexpected.

Apply for homeowners insurance with State Farm

Agent Margaret Ward, At Your Service

With this excellent coverage, no wonder more homeowners prefer State Farm as their home insurance company over any other insurer. Agent Margaret Ward would love to help you get the policy information you need, just call or email them to get started.

So reach out to agent Margaret Ward's team for more information on State Farm's terrific options for protecting your home and collectibles.

Have More Questions About Homeowners Insurance?

Call Margaret at (660) 827-1151 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Can a power surge damage my electronics?

Can a power surge damage my electronics?

Help prevent power surges from zapping your electronics and protect your property from electrical hazards by following these tips.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Margaret Ward

State Farm® Insurance AgentSimple Insights®

Can a power surge damage my electronics?

Can a power surge damage my electronics?

Help prevent power surges from zapping your electronics and protect your property from electrical hazards by following these tips.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.